Sections

Home

Search

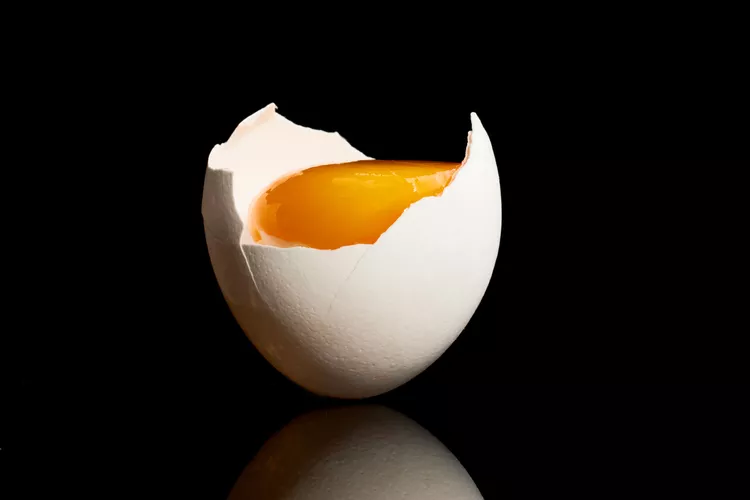

As egg prices climb, minimum-wage earners find themselves stretched even thinner. Rising costs on everyday essentials collide with stagnant wages, creating a financial squeeze that’s tougher to crack than ever before.

Note: This "article" is not affiliated with the NYT, and was made for class

Over the past two decades, inflation has transformed the economic environment for minimum-wage workers, making basic goods increasingly difficult to afford. Imagine this: in 2000, one hour of work at minimum wage could buy a gallon of milk, a loaf of bread, and a dozen eggs. But today, these simple staples often slip out of reach for America’s lowest earners.

The Consumer Price Index (CPI), which monitors fluctuations in the prices of essential products and services, reveals a concerning narrative. From the first quarter of 2000, when the CPI was 169.3, to the third quarter of 2024, when it jumped to 313.5, living expenses have nearly doubled. These numbers are not just statistics—they represent the relentless rise in costs for fundamental needs: food, housing, utilities, and transportation. Essentials once taken for granted, like eggs, have become symbols of inflation’s crushing impact on daily life. For minimum-wage employees, every rise in the CPI is a stark reminder that while prices escalate, their earnings remain stagnant.

The federal minimum wage hasn’t budged since 2009, holding steady at $7.25 per hour. This marks the longest period of wage stagnation since the minimum wage was first established in 1938. During these fifteen years of inertia, the cost of living has continued to climb, forcing minimum-wage earners to make hard choices—stretching each dollar, rationing groceries, and even skipping meals. Although some states have raised their minimum wages, countless workers in states adhering to the federal rate struggle to afford necessities, trapped in an ever-widening divide between income and costs.

An examination of egg prices from 2004 to 2024 reveals a troubling pattern that underscores this challenge. For much of the early 2000s, egg prices remained steady, a modest yet essential part of the average worker’s budget. However, beginning in 2022, prices surged, driven by inflation, supply chain challenges, and rising production expenses, with eggs peaking at more than $4.00 per dozen. Basic needs such as bread, milk, and rent have followed a similar trend, intensifying the financial strain on low-income workers. Despite rising daily expenses, minimum wages have largely failed to keep pace, leading to diminished purchasing power. For these Americans, each paycheck is shrinking, consumed by essential needs that now take up a larger portion of their limited income.

Across the nation, minimum wage regulations vary significantly, creating a fragmented landscape where location shapes economic stability. Some states have increased their minimum wages above the federal standard, providing a slight buffer against inflation. Yet many states still lack minimum wage regulations, relying solely on the federal rate and leaving workers with minimal safeguards. The disparity is stark: in states with elevated minimum wages, workers have a modest shield against rising costs, while those in states adhering to the federal minimum face an increasingly widening gap between income and the cost of living. This divided wage environment underscores the need for a cohesive, fair approach to wage standards that considers the actual expenses of contemporary living.

As of November 2024, five U.S. states—Alabama, Louisiana, Mississippi, South Carolina, and Tennessee—still lack state-mandated minimum wage laws, subjecting their workers to the federal rate. In Georgia and Wyoming, the minimum wage is even lower at $5.15 an hour, although the federal rate applies to most workers. For employees in these states, the lack of state-level protections exacerbates financial insecurity, forcing them to contend with rising living expenses without any additional safety net.

The decline in purchasing power for minimum-wage earners is evident. In 2000, an hour at the minimum wage of $5.15 could buy almost six dozen eggs. But by 2024, with the wage stagnant at $7.25 and egg prices at all-time highs, that same hour’s labor buys less than two dozen eggs. This erosion of purchasing power captures the financial reality for America’s low-wage earners, who must grapple daily with the high costs of basics that now consume their paychecks. Without meaningful wage adjustments, the widening gap between the cost of living and minimum-wage earnings will continue to deepen, leaving millions further behind in an economy rapidly outpacing their ability to keep up.